The Benefits of Reciprocity

I’ve been hearing a consistent message: We need to redefine wealth. I agree. Wealth should not be defined solely by surplus capital, regardless of your income and wealth brackets. Rather, one’s wealth should be defined more holistically, incorporating not only financial wealth, but also human capital, for example, the ability to promote agency, dignity, and societal wellbeing. Moreover, since how we define wealth has great implications for philanthropy, redefining wealth would dramatically shift our beliefs and behaviors in philanthropy in healthy ways too.

These are some of the alternate views about wealth influencing my thinking:

In Braiding Sweetgrass, Robin Wall Kimmerer shares stories from her life and indigenous wisdom that reveal how wealth is measured by “having enough to give away” (2013, pp. 381). Those with wealth are expected to share it, seeing that their wellbeing is connected directly to the wellbeing of everyone in the community. Nature teaches that giving increases the value of the gift — because as a gift moves, it establishes relationships.

In South Africa, the philosophy of Ubuntu can be translated as “I am because you are.” The late, great, Archbishop Desmond Tutu explains, “You need other people in order to be human … you can’t flourish without other human beings.” In his view, we were wired for complementarity and to recognize our interconnectedness. To his dismay, modern life and the corporate ethic teach the opposite — that surpluses generated belong to individuals and are often hoarded (Lama & Tutu, 2016, pp. 270).

In a recent TEDWomen talk that I can’t stop listening to, What Does Wealth Mean to You?, Aisha Nyandoro relates a personal story of setting goals for her personal wealth, defining this as having enough to retire at 60 and also take care of her mother. The wealth advisor with whom she consulted immediately dismissed her second goal. Later, Nyandoro asked the women in her organization, Springboard to Opportunities, which serves Jackson, Mississippi, how they defined wealth. The responses revealed that “wealth is about a sense of agency, a sense of freedom, the collective wellbeing of the whole. It is not an individual pathological pursuit.”

A webinar I recently attended on multigenerational philanthropy featured a fifth-generation family member, Taylor Adams, founder of Belief Partners. Adams defines wealth as “the ability to create value for others.” He submits that transforming the traditional family office paradigm to center human capital rather than financial capital will make the “shirt sleeves to shirt sleeves in three generations dynamic” obsolete.

What all of these examples have in common is that each description of true wealth includes a core value of reciprocity. It is not me v. others, it is me with others. As Edgar Villanueva observes, “Reciprocity means we are only a healthy community if we are taking care of everybody” (2018, pp. 177).

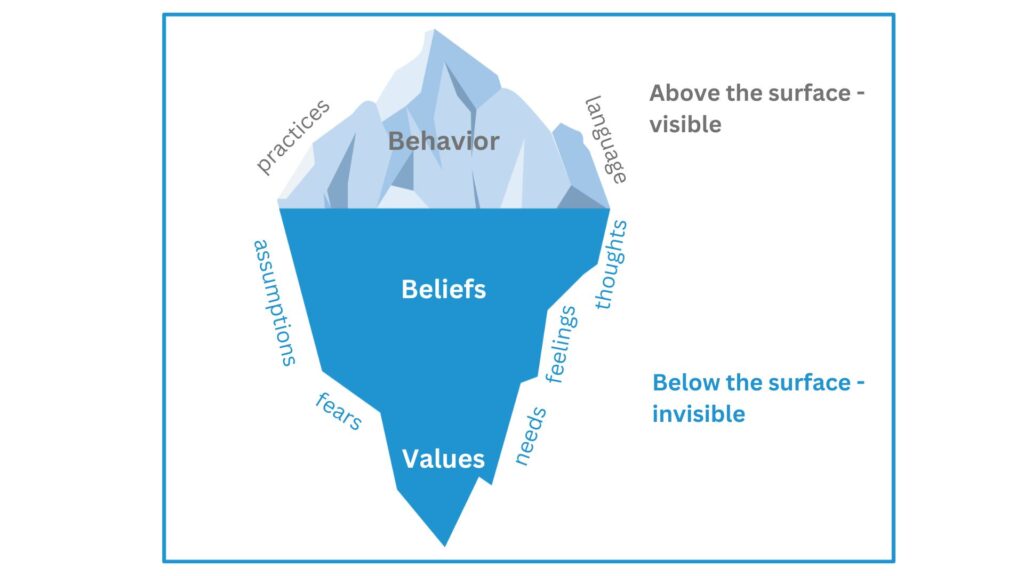

Throughout my career in the social sector and advising individuals and families about giving, I’ve witnessed the harmful power dynamics that are created when we obsess about wealth only in financial terms. It’s useful to consider the iceberg model as an analogy. As little as one-eighth of an iceberg is visible above the surface. This helps us conceptualize how our unconscious values and beliefs influence and shape our visible behavior. A common illustration of the iceberg model looks like this:

There are many great resources on how “money messages” and beliefs about wealth have been taught and handed down through generations. These value systems affect feelings and behavior in individuals, the policies and practices in our institutions, and the narratives in our larger culture.1

Moreover, I’ve frequently witnessed families who receive advice about financial and estate planning without regard to their values at all. It is common practice for investment advisors, accountants, and lawyers to offer ways to maximize financial return and minimize taxes because the dominant paradigm is that wealth should be preserved for the individual and family. In her blog post, A Fresh Frame on Impact Investing for Philanthropists, Nancy Reid engages in a thought experiment of how thinking of oneself as an investor in community, economy, and ecology leads to a very different set of opportunities and choices for individuals in how to manage their investment portfolio decisions.

It is logical to assume that the dominant values and paradigms that we use to define the meaning and purpose of wealth influence the way we think about philanthropy. Under the surface of our iceberg metaphor, a value that centers on wealth as surplus financial capital often creates a scarcity mindset for philanthropists. (I wrote about the scarcity mindset in a previous blog post.) If this value is left unexamined, most philanthropists believe inevitably that once money is given, it is gone, never to be returned. This belief then leads to practices designed solely to ensure that the maximum social return possible is received in exchange for the charitable gift.

We see this in the language surrounding philanthropy — the holy grail for philanthropists is often a desire to be described as “effective” or “strategic.” I have spoken with many philanthropists who report fearing most of all making mistakes and being criticized for wasting money. Other philanthropists report dissatisfaction with giving, sharing that transactional check writing often leaves them feeling dehumanized and as though they are only valued for their money. The profound, usually unconscious, impact that values around wealth have on how it is deployed through investments (including philanthropic investments) is why we at Phīla Engaged Giving begin with a discovery of the deep values that drive our clients.

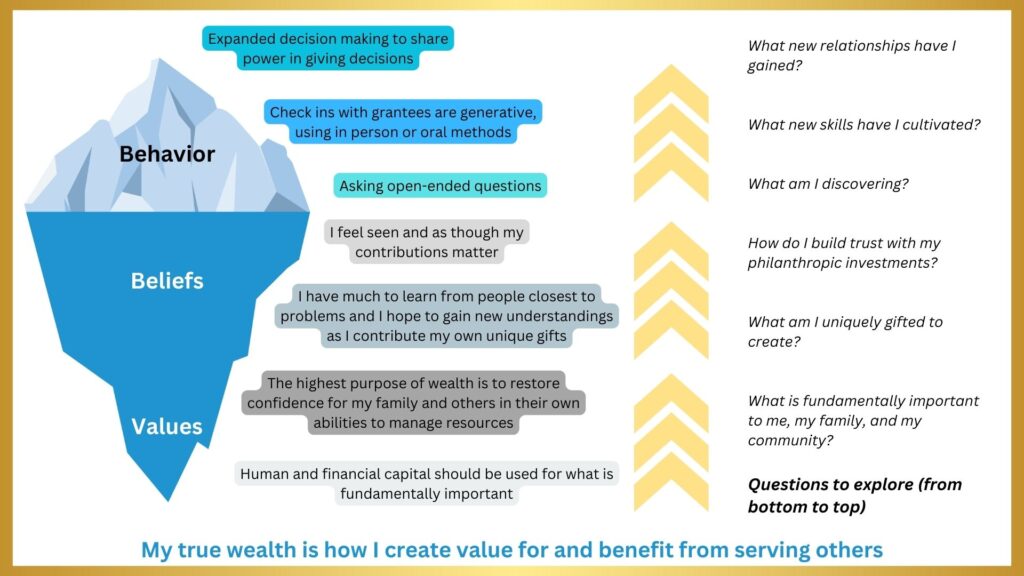

How might redefining the value of wealth to encompass reciprocity (me with others) shift the behaviors of philanthropists and increase satisfaction for all participants in philanthropy? Let’s return once again to our iceberg metaphor — starting from values at the bottom and moving up to visible behaviors. Instead of a traditional value of wealth as surplus financial capital, the new value of wealth might become how we create value for (and benefit from) serving others and even our planet. As a result, the paradigm as a person moves up the iceberg starting with this reciprocal value of wealth might look like this:

This graphic demonstrates that when we value wealth in ways that include reciprocity, then engaging in philanthropy becomes much more than a one-way act of giving money away. It reflects our values whereby the giver receives as well, through participating in human connection and nurturing new relationships.

Ultimately, the values you ascribe to wealth are your own. However, I do propose considering whether reciprocity resonates with your deepest values. If it does, then I believe articulating the underlying value of wealth in terms of reciprocity will not only lead to greater social impact, it will benefit your giving by unlocking deeper joy and more authentic relationships.

_______________

1 See, for example, Goldseker, S., & Moody, M. Generation Impact: How Next Gen Donors Are Revolutionizing Giving. Wiley, 2017; Keffeler, K. The Myth of the Silver Spoon: Navigating Family Wealth & Creating an Impactful Life. John Wiley & Sons, 2023; Walker, D. From Generosity to Justice: A New Gospel of Wealth. Disruption Books, 2023.

Kimmerer, R. W. (2013). Braiding sweetgrass: Indigenous wisdom, scientific knowledge, and the teachings of plants (pp. 381). Milkweed Editions.

Lama, D., & Tutu, D. (2016). The book of joy (pp. 270). Penguin.

Villanueva, E. (2018). Decolonizing wealth: Indigenous wisdom to heal divides and restore balance (pp. 177). Berrett-Koehler Publishers.