The Fiscal Sponsorship Model: A Growing Trend in the Nonprofit Sector

This article was first published in our 11 Trends in Philanthropy for 2024 report. Explore the full report here.

This article was first published in our 11 Trends in Philanthropy for 2024 report. Explore the full report here.

Want the latest trends, research, and more delivered right to your inbox? Subscribe to the Johnson Center email newsletter.

“I want to start a nonprofit” is an unsurprisingly common phrase heard in the nonprofit space — whether from practitioners or legal and philanthropic advisors. Often, the answer is, “Don’t” (Bradrick, 2015; Spicer, 2021; Takagi & Chan, 2009). After all, the process of establishing and managing a nonprofit involves a multitude of challenges, including:

handling back-office operations such as human resources, insurance, and financial management;

obtaining legal certifications like certificates of incorporation, tax exemptions, and charitable solicitation licenses;

forming and managing a volunteer board of directors; and

Moreover, the nonprofit sector already houses nearly 1.85 million organizations (IRS, 2023), potentially leading to service and mission duplication.

In response to these challenges — and as our colleagues Mandy Sharp Eizinger and Tory Martin noted in last year’s Trends report — fiscal sponsorship continues to emerge as an alternative model that allows individuals or groups to engage in charitable activities without establishing a separate nonprofit entity. As the National Council on Nonprofits (n.d.) notes, “In essence the fiscal sponsor serves as the administrative ‘home’ of the cause” (para. 1).

Fiscal sponsorship is a relationship in which an unincorporated group or project seeking to carry out charitable activities affiliates with an existing 501(c)(3) nonprofit organization that shares a compatible mission. Multiple models of fiscal sponsorship exist, each offering a slightly different approach (Colvin & Petit, 2019). However, the most common model, known as Model C or the “preapproved grant relationship,” involves the fiscal sponsor receiving and managing funds on behalf of the project (FiscalSponsorDirectory.org, 2023, para. 18).

As noted by Spack (2005), “fiscal sponsorship is by definition a behind-the-scenes service, … often under the public and philanthropic radar” (p. 24). That last point is important to note: fiscal sponsorship — either as the host or recipient organization — is not currently disclosed on any of the IRS Form 990 annual returns, nor is fiscal sponsorship required to be disclosed on websites or annual reports (Andersson & Neely, 2019). Even so, there are key situations when fiscal sponsorship is the preferred way of implementing a nonprofit’s services (National Council of Nonprofits, n.d.):

when newly formed nonprofits are fundraising before they seek independent status with the IRS;

when a new or existing nonprofit wants to test drive an idea or service that could be a spin-off entity; and

when a collective, organization, or program:

decides that it prefers to focus its efforts on fulfilling its mission instead of on supporting or ancillary activities; or

Additionally, there are many reasons why this model is becoming more attractive:

Efficiency and Shared Administration: By leveraging the infrastructure and experience of existing nonprofits — including financial and risk management, human resources administration, and even capacity-building support — projects can focus on their vision and mission while keeping costs low (Andersson & Neely, 2017; Trust for Conservation Innovation, 2014; Sattely, 2017; Takagi, 2020).

Lower Barrier to Entry: Individuals and groups seeking to engage in charitable activities can immediately access tax-exempt contributions and grant support without the need to navigate the complex process of establishing a separate nonprofit (Sattely, 2009).

Regulatory Compliance and Trust: “Simply stated, fiscal sponsors place responsibility for implementing programs in the hands of project leaders while ensuring appropriate [legal and] fiduciary oversight” (National Network of Fiscal Sponsors, n.d., para. 1).

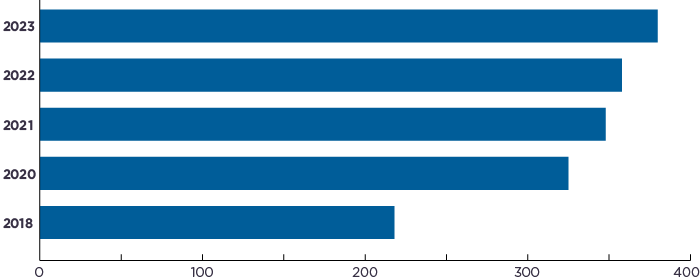

Fiscal sponsorship traces back to a community-based public health initiative in Massachusetts in 1959 (Sattely, 2009). However, interest in the model has been steadily growing over the past two decades.

[W]e know their numbers also are going up. Using Google Alerts, we’ve maintained a list of them for years: The list rose from about 400 in 2021 to 535 last year, and today it’s 600. Combining that list with the Directory’s sponsors puts the known number of fiscal sponsors nationwide at almost 1,000, nine times those surveyed in the first field scan in 2006. (Beggs, 2023, para. 11)

Anecdotal support for increasing interest in fiscal sponsorship is also relatively easy to find.

Organizations like NOPI, a nonprofit incubator in Massachusetts, received applications for fiscal sponsorship and startup support from more than 70 entities nationwide in its last round of funding (2022).

The major issues surrounding fiscal sponsorship include:

Lack of Awareness: Smaller entities in the nonprofit sector often lack awareness of the option to obtain a fiscal sponsor, which could provide them with much-needed capacity support and administrative efficiency (Andersson & Neely, 2019).

Enhanced Disclosures and Transparency: Limited public disclosure of fiscal sponsorship activities can conceal the allocation of resources between the sponsor and the recipient organization, making it challenging for external stakeholders — including funders — to understand how nonprofit resources are used to support recipient organizations (Andersson & Neely, 2019). As noted above, nothing about fiscal sponsorship is currently required in any public disclosure or IRS Form 990 annual return.

The fiscal sponsorship model provides a practical alternative for individuals and groups looking to engage in charitable activities without separately incorporating or standing up their own supporting activities — but with some risks to both the program and the host organization. When implemented properly, fiscal sponsorship offers the potential for efficiency, collaboration, and resource optimization. The increasing presence of this model in the nonprofit landscape and the number of fiscal sponsor organizations at both the regional and national levels demonstrate the model’s utility in the charitable sector.

_______________

1 Calculations by the authors from raw data are available at https://trends.google.com/trends/explore?date=today%205-y&geo=US&q=%2Fm%2F03gsyqm&hl=en.

Andersson, F. O., & Neely, D. G. (2017). Examining the role and diversity of fiscal sponsors in the nonprofit sector. Nonprofit and Voluntary Sector Quarterly, 46(3), 488–504. https://doi.org/10.1177/0899764016664030

Andersson, F. O., & Neely, D. G. (2019). Bringing fiscal sponsor activity to light. Nonprofit Policy Forum, 10(1). https://doi.org/10.1515/npf-2019-0021

Beggs, M. (2023, June 13). Fiscal sponsorship: Up and up. FiscalSponsorDirectory.org. https://fiscalsponsordirectory.org/?p=12947

Bradrick, E. M. (2015, May 21). Fiscal sponsorship: What you should know and why you should know it. Business Law Today, American Bar Association. https://www.americanbar.org/groups/business_law/resources/business-law-today/2015-may/fiscal-sponsorship-what-you-should-know/

Colvin, G. L., & Petit, S. L. (2019). Fiscal sponsorship: 6 ways to do it right. (3rd ed.). Study Center Press.

FiscalSponsorDirectory.org. (2023, March). Directory facts. https://fiscalsponsordirectory.org/?page_id=95

IRS. (2023, October 9). Exempt organizations Business Master File Extract (EO BMF). https://www.irs.gov/charities-non-profits/exempt-organizations-business-master-file-extract-eo-bmf

National Council of Nonprofits. (n.d.). Fiscal sponsorship for nonprofits. https://www.councilofnonprofits.org/running-nonprofit/administration-and-financial-management/fiscal-sponsorship-nonprofits

National Network of Fiscal Sponsors. (n.d.). About fiscal sponsorship. Retrieved October 30, 2023 from https://www.fiscalsponsors.org/about-fiscal-sponsorship

NOPI. (2022). 2022 year in review. https://www.thenopi.org/2022-impact-report

Sattely, J. (2009). A white paper: On comprehensive fiscal sponsorship. Third Sector New England. https://www.tsne.org/sites/default/files/White-Paper-Fiscal-Sponsorship.pdf

Sattely, J. (2017, January 12). Comprehensive fiscal sponsorship helps foundations support the most promising new nonprofits. Third Sector New England. https://www.tsne.org/blog/comprehensive-fiscal-sponsorship-helps-foundations-support-most-promising-new-nonprofits

Sharp Eizinger, M., & Martin, T. (2023, January 18). New organizational structure models are toppling the staff pyramid. 11 Trends in Philanthropy for 2023. Dorothy A. Johnson Center for Philanthropy. https://johnsoncenter.org/blog/new-organizational-structure-models-are-toppling-the-staff-pyramid/

Social Impact Commons, & National Network of Fiscal Sponsors. (2023). Fiscal sponsor field scan 2023: Survey report. https://www.socialimpactcommons.org/fiscal-sponsor-field-scan-2023

Spack, J. (2005, Fall). How fiscal sponsorship nurtures nonprofits. Communities & Banking, 16(4), 22–24. https://fraser.stlouisfed.org/title/communities-banking-federal-reserve-bank-boston-6894/fall-2005-629071

Spicer, T. (2021, February 23). So, you want to start a nonprofit? Dorothy A. Johnson Center for Philanthropy. https://johnsoncenter.org/blog/so-you-want-to-start-a-nonprofit/

Takagi, G. (2020, January 28). Fiscal sponsorship: A balanced overview. Nonprofit Quarterly. https://nonprofitquarterly.org/fiscal-sponsorship-a-balanced-overview/

Takagi, G., & Chan, E. (2009). Alternatives to forming a charitable nonprofit. Business Law Today, 18(6). https://nonprofitlawblog.com/assets/Alternatives-to-Forming-a-Nonprofit-ABA-Bus-Law-Today-Jul-Aug-2009.pdf

Trust for Conservation Innovation. (2014, March). Fiscal sponsorship: A 360 degree perspective. (2014). https://www.chicago.gov/content/dam/city/depts/dca/Grants/nap/fiscalsponsorship.pdf