Nonprofits and Government Revenue: Understanding a Complex Relationship

It’s challenging to keep pace with the wave of federal activity flowing from Washington, D.C. These days, we’re seeing seismic shifts in government grants, significant reductions in the federal workforce, and major policy announcements weekly, if not daily. For nonprofits and foundations, these changes ripple through the sector both directly and indirectly, raising a crucial question: How reliant are nonprofits on federal government funding?

Two studies released in recent weeks tackle this question from different angles, offering insights that not only illuminate the current funding landscape but also reveal persistent gaps in the sector’s data infrastructure.

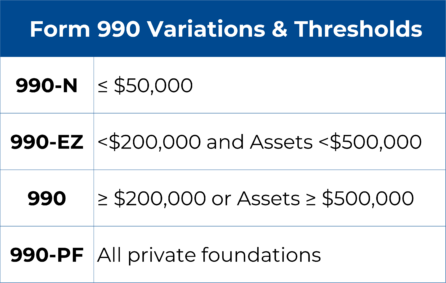

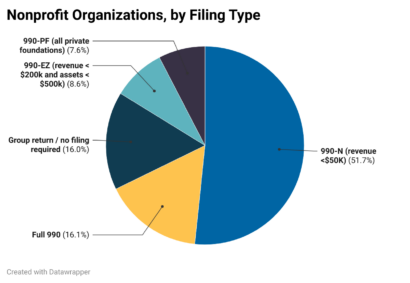

Candid’s February 6 blog post, “How reliant are nonprofits on government grants?” revealed that at least 30% of nonprofits filing IRS Form 990 received government grants in their most recent filing year. Candid calculates that “this translates to over 100,000 organizations being awarded a total of $303 billion annually” — a large figure that begins to reveal the connections between government funding and nonprofit operations.

Candid’s February 6 blog post, “How reliant are nonprofits on government grants?” revealed that at least 30% of nonprofits filing IRS Form 990 received government grants in their most recent filing year. Candid calculates that “this translates to over 100,000 organizations being awarded a total of $303 billion annually” — a large figure that begins to reveal the connections between government funding and nonprofit operations.

But as Candid notes, this analysis comes with important limitations:

First, it only captures Form 990 filers, roughly one-sixth of all U.S. nonprofits. This means we’re missing data from about 85% of nonprofits.

Second, even the full Form 990 doesn’t require organizations to identify other forms of government revenue such as contracts, awards, or cooperative agreements. This blind spot is particularly significant since many health and human service nonprofits rely heavily on federal contracts (not grants) to deliver essential services like after-school programs and job training.

The Urban Institute’s study, released just a day after Candid’s analysis, offers a more comprehensive view. Their fact sheet, “Government Grants and Contracts for Nonprofits in 2023,” draws from a national panel study and reveals that two-thirds of nonprofits “received at least one government grant or contract, resulting in the average nonprofit generating one-quarter of its revenue from government sources that year.” These higher percentages reflect the study’s broader scope, encompassing both smaller organizations and various forms of government funding beyond grants alone.

Both of these new studies highlight a persistent problem: The nonprofit sector, despite its economic and social significance, suffers from a lack of robust, accessible data. Official government sources often lack annual updates tracking nonprofit employment. Even basic statistical data about the sector often requires substantial advocacy and effort to encourage public release.

These studies also highlight the role of advocacy, infrastructure, and academic partners of the nonprofit and philanthropic sectors who have stepped in to try to address these shortcomings.

Whether it’s the Johnson Center’s rapid-response blogs about nonprofit sector finances “In the Time of Coronavirus,” Candid’s wide-ranging “Data & Insights” blogs, Independent Sector’s research on sector health, multi-year initiatives such as Aspen Institute’s Program on Philanthropy and Social Innovation, GivingTuesday’s Data Marts of pre-selected slices of nonprofit data, or the nonprofit employment estimates housed at George Mason University’s Center on Nonprofits, Philanthropy, and Social Enterprise, these independent actors require support, funding, and effort to enable them to track changes in the sector and its impact over time — above and beyond the support needed for direct-service nonprofits.

During administrative transition or economic uncertainty, taking the nonprofit sector for granted is tempting. However, as an industry that employs one in ten U.S. workers, policy changes affecting nonprofits reverberate throughout the economy. Philanthropy is deeply ingrained in the American experience. Still, it is intentionally not a replacement either for the vibrant commercial experimentation of the private sector nor the government’s role to provide basic services and “promote the general Welfare.”

During administrative transition or economic uncertainty, taking the nonprofit sector for granted is tempting. However, as an industry that employs one in ten U.S. workers, policy changes affecting nonprofits reverberate throughout the economy. Philanthropy is deeply ingrained in the American experience. Still, it is intentionally not a replacement either for the vibrant commercial experimentation of the private sector nor the government’s role to provide basic services and “promote the general Welfare.”

In fact, the question posed at the beginning of this piece — “how reliant are nonprofits on federal government funding?” — could be extended to a second question: “could the public rely on philanthropy to replace federal funding when and where it recedes?”

The answer is an emphatic “no.” In 2024, federal expenditures amounted to a total of $6.75 trillion. Totaling all the assets held by private and community foundations in the U.S. — even the furniture and the laptops — amounts to only $1.466 trillion, according to Johnson Center analysis. Philanthropy would run out of money 79 days into one year of the federal budget.

Therefore, while philanthropy plays a vital role in supporting communities, philanthropy does not and could not come close to matching the scale of federal funding.

As we navigate this complex landscape, these studies serve as crucial waypoints in understanding the relationship between government funding and nonprofit operations:

The nonprofit sector’s resilience has been tested repeatedly in recent years. Understanding the relationship with government funding helps prepare the sector for future challenges while maintaining its commitment to serving communities effectively and sustainably.

I hope you take time this week to review these two new studies and bookmark some of these other URLs for your use and reference in the coming months. Please reach out to the Johnson Center if we can support you with data and research services, thought partnership, or other questions you and your organization are facing. Reach Tory Martin, director of communications and strategic partnerships, at martinv@gvsu.edu, or Jeff Williams, director of consulting services, at jeff.williams@gvsu.edu.